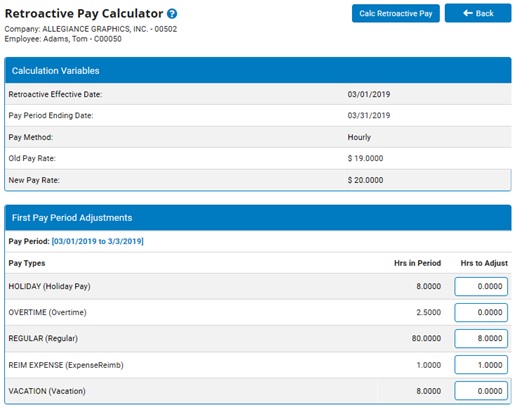

Retro pay calculator with overtime

Regular pay per period. Overtime pay per period.

Handy Basic Retro Pay Calculator Psac Pa Agreement R Canadapublicservants

E D PAPR.

. New rate of 25 per hour Old rate of 22 per hour 3 per hour difference. The retro pay amount is. Now calculate how much you should have paid the employee during the week by adding their.

The amount should be 1730 4500026. HOP HRP m where HOP stands for. Total pay per period.

B A OVWK. 18 regular pay rate x 15. Regular pay per year.

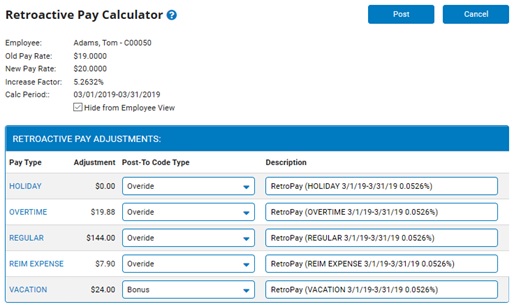

The additional three hours of retro pay not only need to be paid but paid at 15 times the regular pay rate as they are calculated as overtime in the prior pay period. OT Straight Time Pay Regular Rate X OT Hours Not Paid 4. Because the extra three hours of retro pay were assessed as overtime in the previous pay period they must be paid at 15 times the standard pay rate.

3 per hour X 32 hours 96 due. To calculate retro pay we need to consider several aspects including the type of salary the duration of the payroll misstep and the possibility of employee overtime. 4 days X 8 hours per day 32 hours of payment at the old rate.

Number of days between end of pay period and date that paychecks are issued. 240 hours x 1 per hour 240 retro pay. Pay Periods and Interest.

Number of days in employees pay period. You can follow these steps to calculate retro pay. Finally calculate the retro pay by subtracting the amount you paid the employee from the amount you should pay them.

You can use some simple formulas to calculate the overtime salary. The remaining balance an employer owes to a worker compared to what was originally issued during the pay period. The first step to calculate the correct retro pay for an.

Total affected hours x difference in hourly pay retro pay. The additional three hours of retro pay not only need to be paid but paid at 15 times the regular pay rate as they are calculated as overtime in the prior pay period. How to calculate retro pay.

Consider if the pay is hourly or salaried. The employee should have received overtime wages of 75 10 X 15 X 5. The accountant must still withhold the.

OT Rate Base Pay Total Hours Worked 3. First of all you have to calculate your hourly overtime wages. Overtime pay per year.

First day of first pay period. Lets take a look. 18 regular pay rate x 15.

Withhold the appropriate tax amount. OT Time 12 Pay OT. OT Half Time Pay OT Rate X OT Hours Not Paid X 05 5.

The employee is then due additional overtime computed by. C B PAPR. D RHPR RHWK.

In this instance the regular rate is obtained by dividing the 405 straight-time salary by 45 hours resulting in a regular rate of 900. F B D.

Vintage Casio

Fs Cimier Lucerne Vintage Calculator Chronographs Vintage Watches Old Watches Gents Watches

How To Calculate Retroactive Pay Payroll Management Inc

Calculating Retroactive Pay

Top 10 Modern Gadgets With Retro Styling Pics Modern Gadgets Retro Gadgets Retro

What Retroactive Pay Is How To Calculate It Connecteam

Vintage Calculator Design Calculator Design Pocket Calculators Calculator

Vintage Calculator Vector Art Graphics Freevector Com

Excel Formula To Calculate Hours Worked And Overtime With Template Excel Formula Excel Life Skills

How To Calculate Process Retroactive Pay Free Calculator

Calculating Retroactive Pay

Handy Basic Retro Pay Calculator Psac Pa Agreement R Canadapublicservants

Braun Vintage Calculator By Dieter Rams By Christina 3verokot On Dribbble

1

Retro Calculator Designs Themes Templates And Downloadable Graphic Elements On Dribbble

Retroactive

Retroactive Wage Calculation Youtube